Introducing The Unshakeables, a new podcast from Chase for Business and iHeartMedia's Ruby Studio. Small businesses are the heart and soul of this country, but it takes a brave individual to start and run a company of their own. From mom-and-pop coffee shops to auto-detailing garages -- no matter the type of industry you’re in, every small business owner knows that the journey is full of the unexpected. A single moment may even change the course of your business forever. Those who stand firm ...

…

continue reading

A tartalmat a Not Your Average Financial Podcast™ biztosítja. Az összes podcast-tartalmat, beleértve az epizódokat, grafikákat és podcast-leírásokat, közvetlenül a Not Your Average Financial Podcast™ vagy a podcast platform partnere tölti fel és biztosítja. Ha úgy gondolja, hogy valaki az Ön engedélye nélkül használja fel a szerzői joggal védett művét, kövesse az itt leírt folyamatot https://hu.player.fm/legal.

Player FM - Podcast alkalmazás

Lépjen offline állapotba az Player FM alkalmazással!

Lépjen offline állapotba az Player FM alkalmazással!

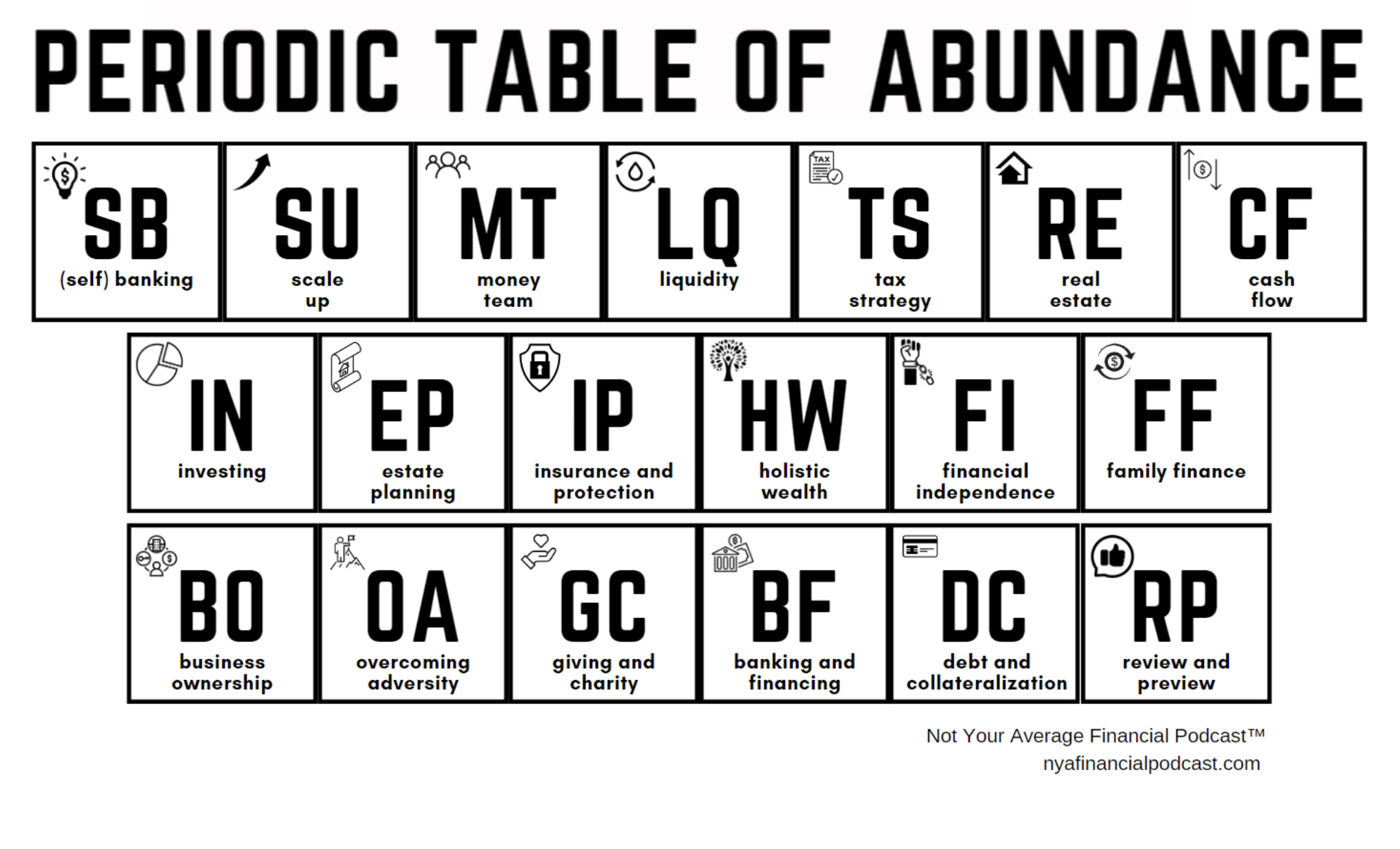

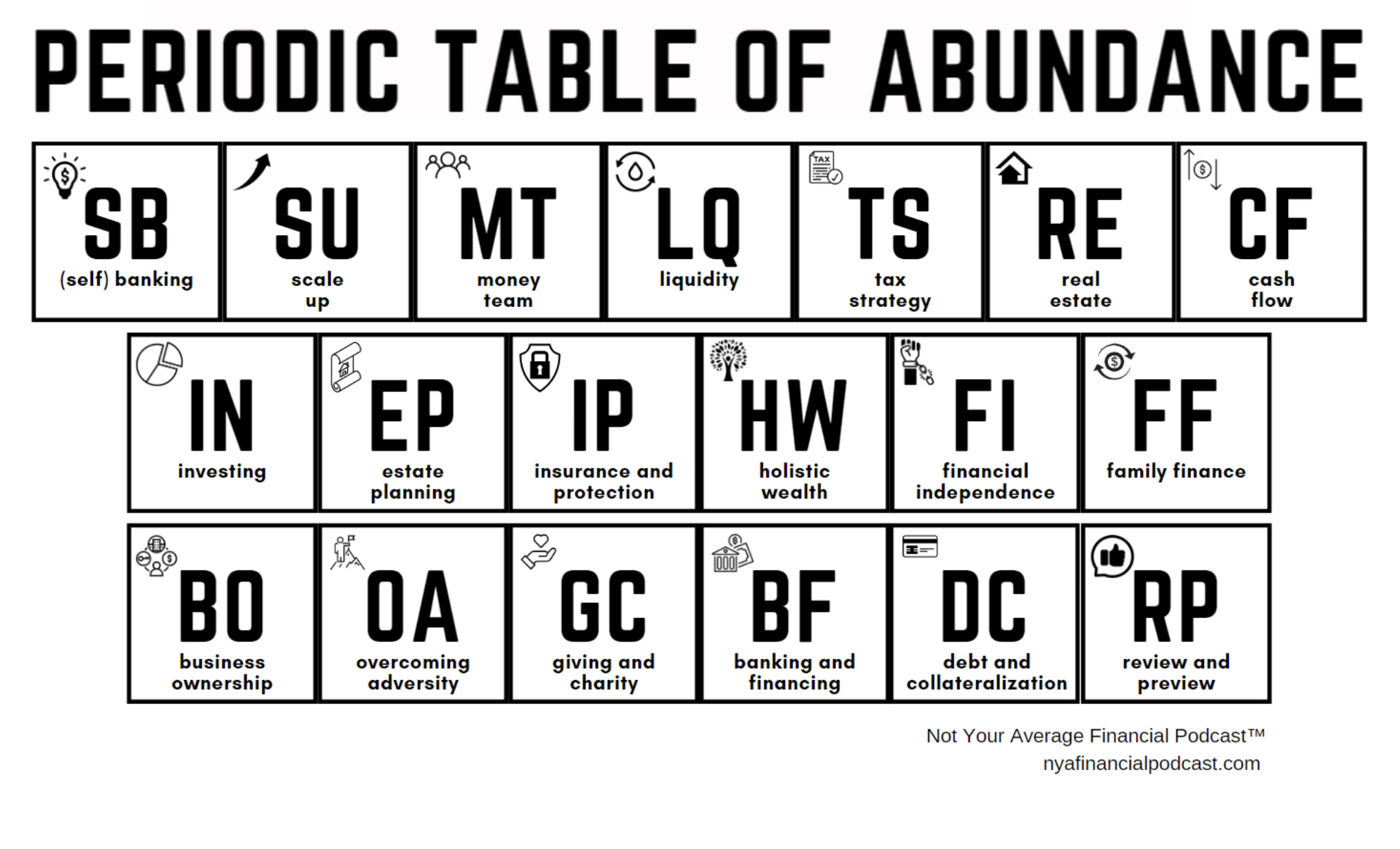

Episode 333: [The Periodic Table of Abundance] No.4 Secrets of Leverage Using Insurance and Banking

Manage episode 396232069 series 1610796

A tartalmat a Not Your Average Financial Podcast™ biztosítja. Az összes podcast-tartalmat, beleértve az epizódokat, grafikákat és podcast-leírásokat, közvetlenül a Not Your Average Financial Podcast™ vagy a podcast platform partnere tölti fel és biztosítja. Ha úgy gondolja, hogy valaki az Ön engedélye nélkül használja fel a szerzői joggal védett művét, kövesse az itt leírt folyamatot https://hu.player.fm/legal.

In this episode, we ask:

- Can information alone change your financial future?

- Would you like to check out our FREE Not Your Average Financial Community?

- Have you listened to the previous episodes in this series?

- Would you like to hear Episode 330: No.1 Scaling Up and Overcoming Adversity?

- Would you like to hear Episode 331: No.2 Money Team, Family Finance and Estate Planning?

- Would you like to hear Episode 332: No.3 Liquidity and Cash Flow?

- What is the essential nature of insurance?

- What is the cost of insurance?

- What creates peace of mind?

- What is the purpose of all of this?

- What outcomes would you like?

- What about guarantees?

- What are the different types of insurance policies?

- What about health insurance?

- Who has medical bills?

- Why have health insurance?

- What about the alternative?

- What are the typical costs?

- What about being uninsured?

- What is the leading cause of bankruptcy in the U.S.?

- What is the health insurance marketplace?

- What about healthcare sharing ministries?

- Would you like to hear Episode 170?

- Would you like to hear Episode 224?

- What about property and casualty insurance?

- What is the average claim?

- What could protect you from financial ruin?

- What about auto insurance?

- What about umbrella insurance?

- What is coverage?

- What is a deductible?

- What about self insurance?

- What about life insurance?

- What happens upon death?

- How will your family afford the costs when you’re gone?

- What about cheap term insurance?

- What about group life plans through employers?

- What about getting insurance that meets your needs?

- What does banking have to do with life insurance?

- Who was Nelson Nash?

- What will you buy in your life?

- What about your need for today’s financing?

- How will you pay for that?

- What is Bank on Yourself®?

- What about living benefits?

- What if you didn’t have to rely on banks?

- What about retirement?

- What about the function of banking?

- What is fractional reserve banking?

- How about an example?

- What is the money multiplier effect?

- Is this magical?

- What are the downsides?

- What happened in 2020?

- What are the reserve requirements now?

- What happened to the reserve?

- What about insolvency and fragility?

- What about the FDIC?

- What percentage of deposits are backed up by FDIC?

- Would you like to hear Episode 299 to learn more about the FDIC?

- What about spending and debt?

- What causes financial stress?

- What is the average American debt?

- Is paying cash the answer?

- What do we do here?

- What about the Bank on Yourself® strategy?

- What about leverage?

- What about private lending?

- Would you like to hear Episode 331?

- So what?

- Are your life insurance policies properly designed and up to date?

- What about an inventory of your own debt?

- Would you like to explore the Bank on Yourself® strategy deeper?

334 epizódok

Manage episode 396232069 series 1610796

A tartalmat a Not Your Average Financial Podcast™ biztosítja. Az összes podcast-tartalmat, beleértve az epizódokat, grafikákat és podcast-leírásokat, közvetlenül a Not Your Average Financial Podcast™ vagy a podcast platform partnere tölti fel és biztosítja. Ha úgy gondolja, hogy valaki az Ön engedélye nélkül használja fel a szerzői joggal védett művét, kövesse az itt leírt folyamatot https://hu.player.fm/legal.

In this episode, we ask:

- Can information alone change your financial future?

- Would you like to check out our FREE Not Your Average Financial Community?

- Have you listened to the previous episodes in this series?

- Would you like to hear Episode 330: No.1 Scaling Up and Overcoming Adversity?

- Would you like to hear Episode 331: No.2 Money Team, Family Finance and Estate Planning?

- Would you like to hear Episode 332: No.3 Liquidity and Cash Flow?

- What is the essential nature of insurance?

- What is the cost of insurance?

- What creates peace of mind?

- What is the purpose of all of this?

- What outcomes would you like?

- What about guarantees?

- What are the different types of insurance policies?

- What about health insurance?

- Who has medical bills?

- Why have health insurance?

- What about the alternative?

- What are the typical costs?

- What about being uninsured?

- What is the leading cause of bankruptcy in the U.S.?

- What is the health insurance marketplace?

- What about healthcare sharing ministries?

- Would you like to hear Episode 170?

- Would you like to hear Episode 224?

- What about property and casualty insurance?

- What is the average claim?

- What could protect you from financial ruin?

- What about auto insurance?

- What about umbrella insurance?

- What is coverage?

- What is a deductible?

- What about self insurance?

- What about life insurance?

- What happens upon death?

- How will your family afford the costs when you’re gone?

- What about cheap term insurance?

- What about group life plans through employers?

- What about getting insurance that meets your needs?

- What does banking have to do with life insurance?

- Who was Nelson Nash?

- What will you buy in your life?

- What about your need for today’s financing?

- How will you pay for that?

- What is Bank on Yourself®?

- What about living benefits?

- What if you didn’t have to rely on banks?

- What about retirement?

- What about the function of banking?

- What is fractional reserve banking?

- How about an example?

- What is the money multiplier effect?

- Is this magical?

- What are the downsides?

- What happened in 2020?

- What are the reserve requirements now?

- What happened to the reserve?

- What about insolvency and fragility?

- What about the FDIC?

- What percentage of deposits are backed up by FDIC?

- Would you like to hear Episode 299 to learn more about the FDIC?

- What about spending and debt?

- What causes financial stress?

- What is the average American debt?

- Is paying cash the answer?

- What do we do here?

- What about the Bank on Yourself® strategy?

- What about leverage?

- What about private lending?

- Would you like to hear Episode 331?

- So what?

- Are your life insurance policies properly designed and up to date?

- What about an inventory of your own debt?

- Would you like to explore the Bank on Yourself® strategy deeper?

334 epizódok

Minden epizód

×Üdvözlünk a Player FM-nél!

A Player FM lejátszó az internetet böngészi a kiváló minőségű podcastok után, hogy ön élvezhesse azokat. Ez a legjobb podcast-alkalmazás, Androidon, iPhone-on és a weben is működik. Jelentkezzen be az feliratkozások szinkronizálásához az eszközök között.